QuickBooks Online will mark your bills paid automatically and will remove them from the list of outstanding bills. Learn about the ins and outs of creating and sending out invoices in QuickBooks. Entering bills and paying bills directly through QuickBooks will help you manage your accounts payable. When you pay bills, you should either print your checks or use online bill payment linked to QuickBooks. The best accounting software for your small business are QuickBooks Online and Zoho Books. These two software products provide a wide range of accounting features at an affordable price.

QuickBooks Online is a cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options. QuickBooks Desktop is an on-premise software that needs to be installed on the computer where you use it and is available as an annual subscription. For more information about the differences between the two programs, read our article on QuickBooks Online vs QuickBooks Desktop.

You don’t need to be a certified public accountant or even have an accounting degree to use QuickBooks Online successfully. While some basic bookkeeping knowledge would be helpful, it’s not required. In our free QuickBooks course, we will teach you what you need to know to manage your own books. About half of the tutorials have an average runtime of five minutes or less, and the longest tutorial is slightly less than 14 minutes long.

QuickBooks Video Tutorials

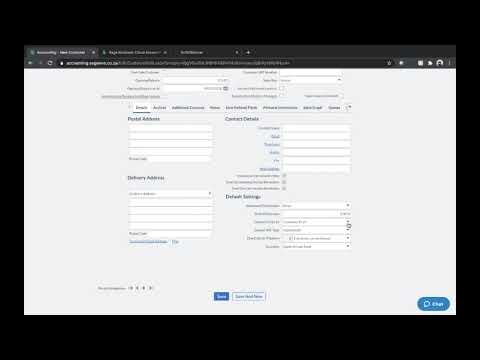

You can upload an unlimited number of receipts to QuickBooks Online as the receipts are stored in the cloud along with your data. Note that you must first enter your bills in QuickBooks Online and then pay them online by clicking the + New button and then selecting Pay bills online. You can also create an invoice from scratch or by converting an existing estimate into an invoice. Then, customize the invoice by changing the color and adding your company logo. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

ASBTDC Sets March and April 2023 Training Events Arkansas … – ATU News

ASBTDC Sets March and April 2023 Training Events Arkansas ….

Posted: Thu, 09 Mar 2023 19:10:57 GMT [source]

Any https://bookkeeping-reviews.com/ that you receive a statement for that has a beginning and ending balance can be reconciled. QuickBooks Online integrates with hundreds of business applications available in the QuickBooks App Store. These integrated apps are designed to help you simplify the various aspects of your business, from bill management and payment acceptance to cash flow forecasting. When you enter employee time as discussed above, the hours not only flow to your invoices but also to the payroll module. This way, you can be confident that every hour you pay your employee is also considered for billing to a customer. Learn how to create custom templates and add custom fields to your invoices in QuickBooks.

Second, you will be able to manage what you owe to vendors by entering and tracking bills. You will learn to enter the payment of these bills correctly so that the expense is not recorded twice. Whether you are new to QuickBooks Online or could use a better understanding of the program, these tutorials are designed for you.

Connect Your Apps

You can set up the option to allow your customers to pay QuickBooks invoices online via ACH bank transfer. One of the best things about QuickBooks Online is that they have a user-friendly interface. All QuickBooks Online products have the same interface, and so do all the QuickBooks Desktop products. There are also available free online training resources that you can use to get up to speed quickly.

Best Accounting Software for the Self-Employed Top 5 in 2023 – Tech.co

Best Accounting Software for the Self-Employed Top 5 in 2023.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

These accounts are useful for tracking income, expense, assets, liabilities, and equity accounts that might be required on your tax return. You can also enter bills into QuickBooks when you receive them so that QuickBooks can help you track upcoming payments. You can ensure that you pay your bills on time by creating an accounts payable (A/P) report. This report will provide you with the details of your current and past-due bills. The ability to pay bills and track unpaid bills is available in QuickBooks Essentials and higher plans.

Find out about how to update invoices and choose what information customers see on invoice. It is important to properly record your outsourced payroll in QuickBooks. If you don’t handle your payroll transactions correctly, you could over-state or under-state your expenses and net income. Knowing how to add and organize new accounts in QuickBooks is important. You should know the differences between the account types and how to choose the correct type.

Ways Small Businesses Use QuickBooks

QuickBooks is the most popular small business accounting software used to manage income and expenses and keep track of financial health. You can invoice customers, pay bills, generate reports, and prepare taxes. The QuickBooks product line includes several solutions to support different business needs, such as QuickBooks Online, QuickBooks Desktop, QuickBooks Payroll, and QuickBooks Time. Our course starts with setting up QuickBooks Online for your business.

If you’re a freelancer, you should consider QuickBooks Self-Employed. Learn which is right for you in our QuickBooks Online version comparison guide. QuickBooks for Mac is the only QuickBooks desktop product available for Mac users. This edition is very similar to QuickBooks Desktop Pro, and it works well for most small businesses that don’t manufacture products.

How is QuickBooks different from MS Excel?

If you’re a startup with plans of expanding your workforce, QuickBooks Self-Employed won’t be the best fit as it cannot be upgraded to other QuickBooks versions. QuickBooks Enterprise is for large enterprises with complicated pricing and heavy inventory. In addition to some native QuickBooks Online integrations—such as QuickBooks Payroll, QuickBooks Time, and QuickBooks Payments—QuickBooks Online connects with popular apps.

These include PayPal, Melio, HubSpot, Expensify, LeanLaw, Square Payroll, and Expensify. The Statement of Cash Flows in QuickBooks will show you all of the activities that affect the operating, investing, and financing cash inflows and cash outflows for your business. Learn about how to add a new supplier to save time, edit supplier information and add columns and sort the Supplier List to get more insight. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. Outsourcing your bookkeeping is more affordable than you would think.

You can also track your business mileage and view financial reports from your smartphone. The QuickBooks Online mobile app is available for download on Google Play and App Store, but you need an active subscription to use its features. Available in Plus and Advanced, the inventory management feature helps you track the quantity and cost of your inventory. As you sell inventory, QuickBooks will allocate a portion of your inventory to the cost of goods sold automatically, which is an expense account that reduces your income. This allocation is a requirement for calculating taxable income and very cumbersome to do by hand. QuickBooks can also remind you to order inventory automatically when quantities are low.

QuickBooks Self-Employed is ideal for freelancers, real estate agents, and independent contractors, like Uber and Lyft drivers. Similar to QuickBooks Online, it’s a cloud-based product that can be accessed with your secure login from any computer with an internet connection. QuickBooks comes in both a cloud-based online platform and a traditional desktop program. You can read about the pros and cons of each in our QuickBooks Online vs Desktop comparison. Most of the online and desktop versions will perform the tasks discussed above, but they come with an extensive variety of advanced features and a wide range of prices. Learn about how to navigate QuickBooks Online, understand the difference between the Navbar, Create menu, and Gear menu, and learn how to enter new transactions.

Track Inventory

You need at least QuickBooks Essentials to track billable hours and Plus to track billable expenses. By managing all of your cash inflow and outflow activities in QuickBooks, you can print financial statements that provide useful information about how your business is performing. Lenders often require financial statements when you apply for a small business loan or line of credit. To pay your first bill, you need to enter your bank account information, the payment method you’d like to use, and how your vendor would like to receive their payment. QuickBooks Online will then use this information automatically to process future transactions, reducing data entry.

You will also learn how to apply payments received to outstanding invoices so that your accounts receivable (A/R) is up to date and income is not counted twice. After this lesson, learn about A/R aging reports, which will help you manage unpaid invoices. While there are many good accounting software options for businesses, we rated QuickBooks Online as the best. These free QuickBooks tutorials will help you harness the power of QuickBooks Online while saving you time and frustration. If you’re ready to purchase the product, Quickbooks Online is offering new customers 50% off for three months or a 30-day free trial. One of the best ways to improve your cash flow is to offer customers the option to pay their invoices online.

In this components of a statement of shareholders‘ equity, you will learn how to set up key areas of QuickBooks like bank and credit card accounts, invoice templates, products and services, and the chart of accounts. By the time you complete this QuickBooks online tutorial, you will be ready to start using QuickBooks to manage all of your income and expenses. It comes in a variety of editions and has web-based and desktop programs. QuickBooks includes features that allow you to keep track of your income and expenses, pay your employees, track your inventory, and simplify your taxes.

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

QuickBooks will generate important reports that will provide you, your accountant, and your banker important insights into the financial health of your business. By the end of this lesson, you will be able to manage credit card sales with either a QuickBooks Payments account integrated with QuickBooks or a third-party credit card processor. You should consider accepting credit card payments as a convenience for your customers and to increase the speed that you collect outstanding invoices. The QuickBooks Online mobile app allows you to execute various accounting tasks from your mobile devices.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

Available for Android and iOS devices, it lets you create and send invoices, accept payments online, and assign expenses to projects or customers. Perhaps the most important thing QuickBooks can do for your small business is to simplify tax time. By far, the largest headache in preparing a tax return is compiling your income and expenses.